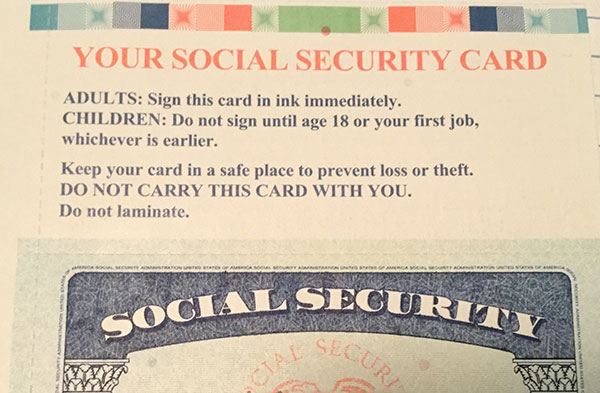

Your Social Security Number demands your protection!

I feel that one thing that we give away too freely is our Social Security Number. In the wrong hands, this is the single best way for our financial identify to be compromised. This key piece of personal information demands to be guarded carefully.

How do you best protect yourself against theft of your SSN? Only give your SSN to others when it is required!

Social Security Numbers (SSNs) were created in 1936 and originally intended to be used exclusively by the federal government for recording individual worker’s contributions to the the Social Security fund. Because it is a source for information about the earnings for all US workers, other governmental agencies and businesses also began using this as an authoritative source for identifying workers and retirees. That’s when many businesses and institutions began requesting your SSN as a part of their application and sign-up processes. From there, your SSN was and continues to be used for ID badges and online accounts across the U.S.

Next thing you know, SSNs for many of us were in the hands of colleges, doctor’s offices, utility companies and many other places. This created a rich “honey-pot’ for those wanting to commit fraud by stealing SSNs to assume the identity of another.

Why would someone want to steal your SSN? They would use it to become you in a digital world. With our SSN, someone could create a fake identity using your number. With that they could get a driver’s license or state ID card which opens the door for completely becoming a fully functioning U.S. Citizen in every way. In our digital world, this can happen very quickly from anywhere in the world without standing in any waiting lines.

A prudent man sees evil and hides himself,

The naive proceed and pay the penalty.

Proverbs 27:12 NASB

Here's 3 key things that you must know to protect your Social Security Number.

1. You are legally required to provide your SSN to businesses and institutions in these specific cases ONLY:

a) You’re engaging in a transaction that requires notification to the IRS. This is true for anyone that pays you taxable wages or governmental benefits. This also includes banks, real estate purchases and financial transactions over $10k.

b) You’re engaging in a transaction that is subject to Customer Identification Program rules. This includes financial transactions in which the federal government requires a positive ID as a result of the USA Patriot Act.

c) The requestor is an insurance company.

d) The requestor is a credit card company.

e) The requestor is one of the three main consumer reporting agencies (Equifax, Experian and TransUnion).

2. Note that the following businesses and entities have been known to request but NOT require this sensitive information.

1) Social organizations

2) Doctors

3) Landlords

4) Colleges

5) Online membership sites

6) Churches or other charities

3. The Social Security Administration recommends that you ask the following questions when requested to give your SSN to a business or organization that is not required by law to possess this information.

1) Why is my SSN needed?

2) How will my SSN be used?

3) What happens if I offer an alternative number (like driver’s license) or refuse to give my SSN?

4) What law requires me to provide my SSN for this purpose?

If a company is required by law to request your SSN these questions are very familiar to them.

The Privacy Act of 1974 requires that governmental agencies disclose to you the answers as they request your SSN. Private business may or may not comply to this act and unfortunately there’s no penalties for this.

If you’re not getting collaborative feedback from your questions, ask to speak to a manager and attempt to persuade them to use your driver’s license as an alternative to your SSN. With no compromise being offered, your choices are to either provide them with your SSN or take your business elsewhere. There is no law in preventing a business from requesting your SSN and there’s likewise no law that prevents them from denying to serve you if you refuse.

I’ve had luck in supplying my drivers license for businesses that needed to have a way to reference me by an additional external identifier in the past. I also did not win the battle for a new doctor that I was visiting and I was just too weak to fight it. It can go either way but definitely worth a try!

Protect your identity by knowing who requires your SSN before you give it out. It’s the prudent and wise thing to do!

Carolyn